HYPE Extends Its Slide with a 9% Drop as Whales Load Up: Time to Buy the Dip?

- HYPE drops 9 percent as selling pressure deepens, and major support levels give way.

- Long liquidations rise while whales buy millions and expand their HYPE exposure.

- RSI shows early divergence as market sentiment sinks and the fear index hits 25.

HYPE spent the new week under pressure, sliding more than 9% on Tuesday and sinking toward the $27.92 area. The decline marks one of its sharpest daily drops in recent weeks and pushed the token’s market value down to roughly $9.4 billion, a fall of about 8.6% over 24 hours.

Market conditions across the sector were already soft, with the broader crypto market losing 1.68% and sentiment stuck in fear territory. The Fear and Greed Index sat at 25, reflecting uncertainty rather than panic, but far from optimism.

Interestingly, as traders backed away, several large holders appeared to move in the opposite direction, adding fresh HYPE to their portfolios even as price momentum weakened.

Technical Structure Shows Deepening Bearish Momentum

The HYPE chart has carried a familiar pattern for days: lower lows, lower highs, and a steady drift below levels that previously acted as support. One of those breaks was the 23.60% Fibonacci level at $31.98, which failed to hold once sell-side momentum picked up.

Besides, the region around $36-$35, which once provided support, now acts as a cap on any short-lived recovery attempts. Both the 50-day and 200-day moving averages now sit above the price and tilt lower, and their recent death cross has only reinforced the sell-side’s grip on the market rather than easing pressure.

Traders often look at that crossover as a sign that an asset may continue to struggle, and HYPE has been no exception. Momentum indicators, on the other hand, tell their story. The RSI has slipped toward 33, pushing it closer to oversold territory.

On-Chain Metrics Confirm Bearish Sentiment Across Traders

The shift in positioning has been clear on the futures side. Open interest, often used to gauge how many traders are willing to stay in the market, has cooled steadily since late October.

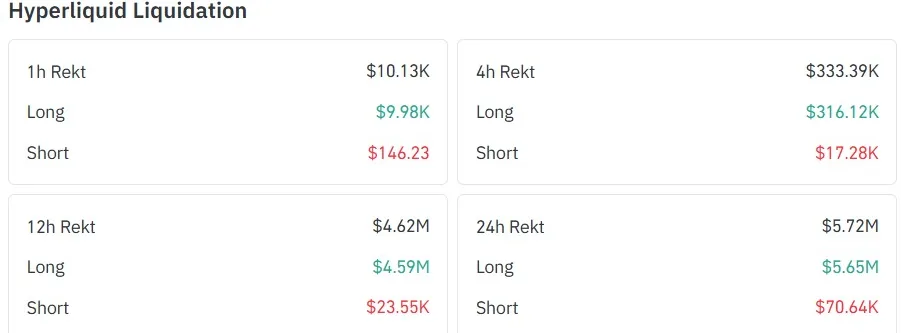

From a peak of $2.08 billion, it has fallen to around $1.47 billion, suggesting participants are unwinding exposure rather than building new positions. Liquidations showed the imbalance even more starkly.

Over the past day, more than $5.6 million in long positions were forced out compared to only $70.64k in shorts. Such a skew points toward a market caught in a long squeeze, where traders betting on upside become the ones pushing the price further down as their positions close.

That type of environment usually signals hesitation and a preference for caution. The quieter volatility profile reinforces that traders are stepping aside rather than leaning into risk.

Whales Accumulate as Retail Pulls Back

Even as smaller traders lighten their exposure, a different group has been buying. Onchain Lens data shows sustained accumulation during the downturn. One of the more active wallets, “nolimithodl.hl” (0x330), used $2.9 million USDC to purchase 98,739 HYPE at about $29.37.

Another address, 0x1EC, brought its holdings to 97,697 HYPE after adding $1.3 million USDC worth of tokens. That account still holds more than $1 million in USDC, suggesting that its recent purchases may not be the end of its activity.

The contrast is striking: derivative traders are scaling back, while deep-pocketed holders continue to gather tokens at lower prices.

Related: BCH Rally Heats Up as Price Climbs 40% YTD Toward Rising Wedge Apex

Market Outlook: Dip Opportunity or Continued Weakness?

HYPE is navigating a messy stretch. Technical signals lean heavily bearish, with the breakdown of support and the long squeeze adding weight to the decline. Open interest trends support the idea that the market is losing confidence.

At the same time, large buyers have continued to accumulate, and early momentum divergence hints at a possible change in tone, though nothing is confirmed yet.

For now, HYPE sits between a market that wants caution and a group of whales willing to step in during weakness. That tension is shaping the token’s present moment.