Michael Saylor Declares Bitcoin ‘On Sale’ After Price Falls Below $100K

- Saylor declares Bitcoin “on sale” as BTC dips below $100K, sparking renewed investor interest.

- BTC nears key support at $98K–$100K; holding could spark a rebound toward $106K–$112K.

- Whales accumulate near $100K while retail traders boost short positions across futures markets.

Strategy’s chairman and CEO, Michael Saylor, once again ignited market discussion after posting a brief but impactful message on X: “Bitcoin on Sale.” The three-word statement arrived shortly after Bitcoin’s price fell toward the $100k mark, triggering a wave of renewed investor attention.

The timing of Saylor’s post coincided with Bitcoin revisiting $98,900, its lowest point of the week, before rebounding to around $104,500. Traders interpreted his message as a sign of confidence in Bitcoin’s long-term trajectory, reinforcing the “buy-the-dip” narrative that has followed each of Strategy’s prior accumulation phases.

Price Action Shows Mixed Short-Term Signals

Bitcoin’s price movement recently displayed a brief recovery, but it soon lost momentum. After climbing nearly 6% to hit $104,500, BTC slid again toward the $100,000 mark, showing a 2% daily decline by press time.

The technical data places the asset near the lower boundary of a long-term ascending wedge pattern, a critical support area that aligns with the 50% Fibonacci retracement level and a Murrey Math pivot. Analysts suggest that if Bitcoin maintains support near $98k–$100k, it could rally back to the $106k zone.

A successful retest could mark the first signal of a bullish reversal, potentially paving the way toward $112k. Conversely, a confirmed weekly close below current support would risk deeper corrections toward $94k and $87k, aligning with the 38.2% Fibonacci retracement. Momentum indicators currently lean bearish, with the relative strength index (RSI) at 44, pointing to weakening short-term confidence.

Related: SUI Holds Key Support at $2: What Comes Next, Surge or Dip?

On-Chain Metrics Reveal Diverging Whale and Retail Behavior

Despite near-term price weakness, on-chain data points to diverging sentiment between large-scale and retail investors. According to CryptoQuant, whale activity has surged between the $100,000 and $105,000 range since early November. At press time, the platform’s Bitcoin Spot Average Order Size chart shows dense clusters of large green markers, signals of whale accumulation.

This accumulation follows a quieter phase when whale participation waned between June and October. The current uptick in large order sizes suggests that whales view the sub-$105k zone as an attractive accumulation region during consolidation.

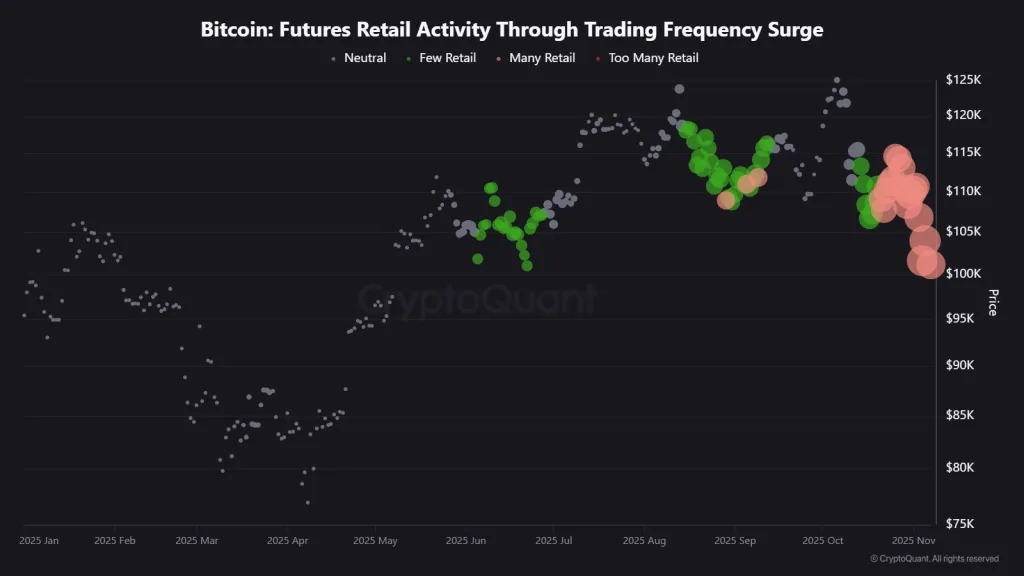

In contrast, retail traders are increasing short exposure in the derivatives market. Data from CryptoQuant’s Futures Retail Activity Through Trading Frequency Surge chart shows intensified short positions between $100,000 and $110,000, visualized by clusters of red and pink nodes.

Earlier in the year, between June and August 2025, retail activity appeared more neutral as prices fluctuated between $110k and $125k. The current imbalance indicates that retail participants expect further downside, even as whales quietly expand their spot holdings, a divergence often preceding sharp market shifts. In summary, market sentiment remains mixed while Bitcoin’s price hovers near key support levels, whale accumulation suggests sustained long-term confidence.