Pi Coin Drops From $3 to $0.35 but Miners Stay Loyal

When Pi Coin began trading on external exchanges in February 2025, it looked poised to be the next big thing in crypto. The token — mined via a mobile app that requires no specialized hardware — surged close to $3 in its first days of trading. By mid-September 2025, the excitement had faded. Pi’s price slid to $0.35, an 80% drop that erased over $16 billion in market value.

For many projects, such a collapse might mark the end. Yet Pi Network continues to hold the attention of millions of users worldwide. With 15.9 million registered accounts and a mining model built around everyday smartphones, the community remains unusually engaged. Events, ecosystem projects, and the hope of eventual large-scale adoption continue to drive belief among its supporters.

Wealth Concentration: The Rich List and Its Implications

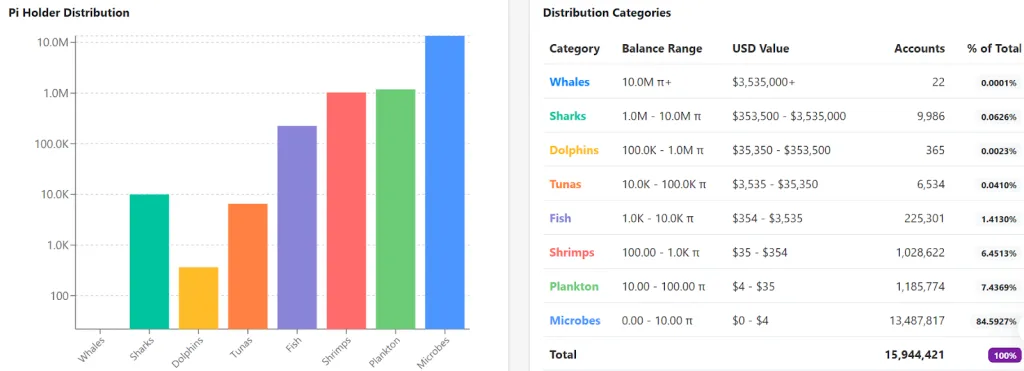

Fresh data from PiScan reveals a sharp imbalance in ownership. Just 22 wallets hold over 10 million Pi each, worth more than $3.5 million per wallet at current prices. Together, these accounts dominate supply and stand in stark contrast to the majority of holders.

At the top sits the Pi Foundation’s primary wallet, controlling over 52 billion coins — valued at more than $18 billion at February’s peak. Additional foundation wallets hold billions more, including Pi Foundation 14 with 9.5 billion coins and Pi Foundation 3 with 4.6 billion. These reserves, while intended to fund ecosystem development, raise questions about whether Pi can function as a truly decentralized cryptocurrency.

The distribution data illustrates this imbalance. Around 13.4 million “microbe” accounts hold less than 10 Pi each. Another 1.1 million “plankton” accounts have between 10 and 100 coins. In total, more than 84% of users fall into these two lowest categories. Meanwhile, just under 10,000 “shark” accounts and 22 “whales” hold most of the supply.

This concentration creates risks for market stability. A sudden sell-off by one of the major wallets could overwhelm trading activity and drive prices even lower. For a network that promotes itself as “the people’s cryptocurrency,” the rich list undermines its potential for inclusivity.

Related: Pi Network: The Sleeping Giant Moving Towards Real Utility

Whale Activity: Accumulation Despite the Crash

Despite Pi’s steep decline, some large wallets have continued accumulating. One address labeled GAS…ODM has drawn particular attention. Over recent months, it purchased more than 331 million Pi, worth about $148 million. Notably, these acquisitions came during price dips rather than peaks, suggesting a long-term strategy.

The identities of these whales remain unclear. Analysts and community members have put forward several theories:

Core Team or Infrastructure Accounts: Some believe the Pi Core Team controls several of these wallets for reserves, buy-backs, or network stabilization. Transfers of over 550 million Pi from foundation wallets during 2025 lend support to this view.

Exchanges Preparing for Listings: Others suspect that major exchanges could be accumulating supply in anticipation of future listings. Transactions linked to Gate.io, Bitget, and OKX have already been noted.

Strategic Long-Term Investors: Another possibility is that wealthy individuals or funds are quietly building positions. Their willingness to accumulate during declines points to confidence in Pi’s eventual adoption.

Whatever the case, whale activity remains central to Pi’s market behavior. For smaller holders, this creates both concern and hope — concern about volatility, but hope that large players are positioning for growth.

The Role of Upgrades and Ecosystem Development

While price trends dominate headlines, the Pi Core Team continues to advance technical upgrades. In September 2025, Pi confirmed its migration from protocol version 19 to version 22 across Testnet1, with plans to reach version 23. These updates aim to improve blockchain performance, security, and scalability.

They also embed Know Your Customer (KYC) authority at the protocol level, enabling more distributed verification and enhancing compliance. However, in September 2025, Pi Network introduced a Fast Track KYC feature using AI, letting eligible Pioneers activate a Mainnet wallet before 30 mining sessions. This grants earlier access to Pi apps and the ecosystem. However, according to the Pi Network’s team, Mainnet migration is not yet included.

The team has also invested in tools to attract developers. Pi App Studio and Pi AI Studio offer frameworks for building blockchain-based and AI-driven applications. Meanwhile, the Pi Ad Network supports app monetization. These initiatives form part of a broader effort to create utility beyond speculation.

Despite these moves, adoption remains limited. Few businesses accept Pi as payment, and many of the apps within its ecosystem are experimental. Critics label the chain a “ghost network,” pointing to its low usage outside of mining and trading. Still, for the community, each upgrade and new tool represents incremental progress toward legitimacy.

Community Events and Resilient Belief

The Pi community, often referred to as “Pioneers,” has played a key role in keeping the project alive. Large-scale events such as PiFest and Pi2Day showcase merchants willing to experiment with Pi as a payment method. Online forums remain active, with members discussing app ideas, mining updates, and price speculation.

Upcoming appearances also generate excitement. The Pi Network will participate in the TOKEN2049 conference in Singapore on October 1-2, 2025, with co-founder Dr. Chengdiao Fan delivering a keynote speech. Her focus on real-world blockchain applications is expected to reinforce the project’s message of utility and inclusivity.

Such events help maintain morale even as the token trades near its all-time low. For many users who began mining Pi years ago, the project still holds symbolic value as a grassroots experiment in accessible crypto.

Competition and the Broader Market Context

Pi’s decline coincides with a broader surge in alternative tokens. During the same period, assets like Solana, Jupiter, and Pudgy Penguins gained traction, particularly in Asia. Pudgy Penguins, in particular, have trended heavily on Chinese social media, capturing investor attention that might otherwise flow toward Pi.

This shift highlights Pi’s challenge: sustaining attention in a crowded market where newer projects often provide faster gains or clearer utility. With major exchanges reluctant to list Pi, its visibility has also lagged behind rivals.

Related: Weak Volume Pushes Pi Below $1 Despite Market Cap Growth

Conclusion: Can Belief Outlast the Numbers?

The Pi Network stands at a crossroads. Its launch onto exchanges delivered the long-awaited chance to trade, but the result was an 80% crash that exposed weaknesses in liquidity, distribution, and utility. The PiScan rich list revealed deep wealth concentration, with foundation wallets and whales controlling the vast majority of coins.

Yet millions of smaller users remain engaged. They continue to mine, attend events, and share optimism about future upgrades. The project’s ongoing protocol improvements, coupled with whale accumulation during downturns, give some reason to expect resilience.

The next phase will depend on whether Pi can deliver tangible utility, decentralize ownership, and secure major exchange listings. Without those milestones, the narrative of a “people’s cryptocurrency” risks fading into a cautionary tale. For now, belief remains Pi’s strongest currency — even as its market value struggles near record lows.