Polygon Records $1.82B in Payments and $1.1B in RWAs

- Polygon’s Q3 payments hit $1.82B, showing sustained growth across financial networks.

- Over $1.1B in tokenized assets positions Polygon as a fintech backbone for Web3.

- Polymarket has gained $234.7 million in TVL, reflecting a rise in blockchain activity.

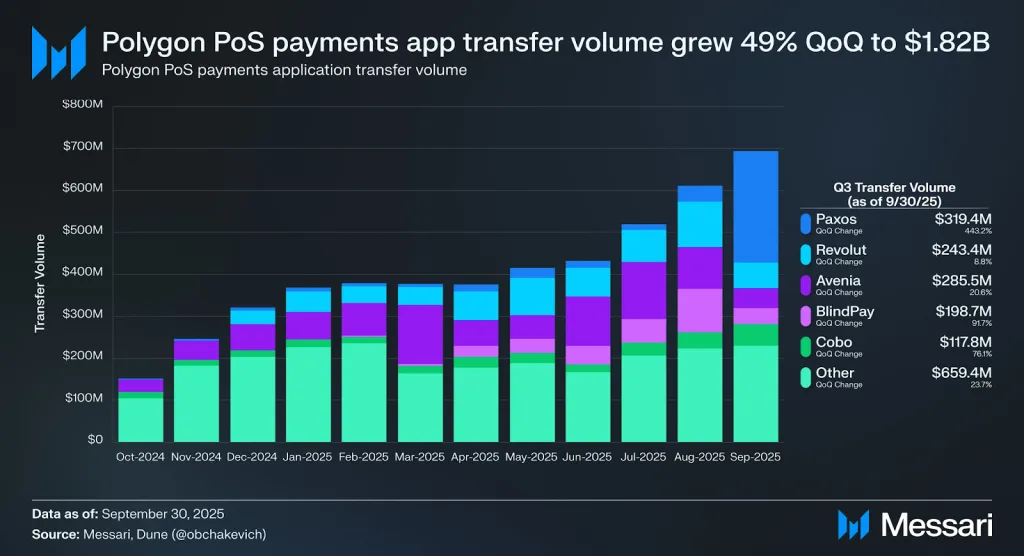

Polygon’s Q3 2025 performance revealed a decisive step toward real-world financial integration. The network’s PoS payments system recorded $1.82 billion in transfer volume, representing a 49% quarter-over-quarter surge, according to data from Messari and Dune shared by CryptoRand on X.

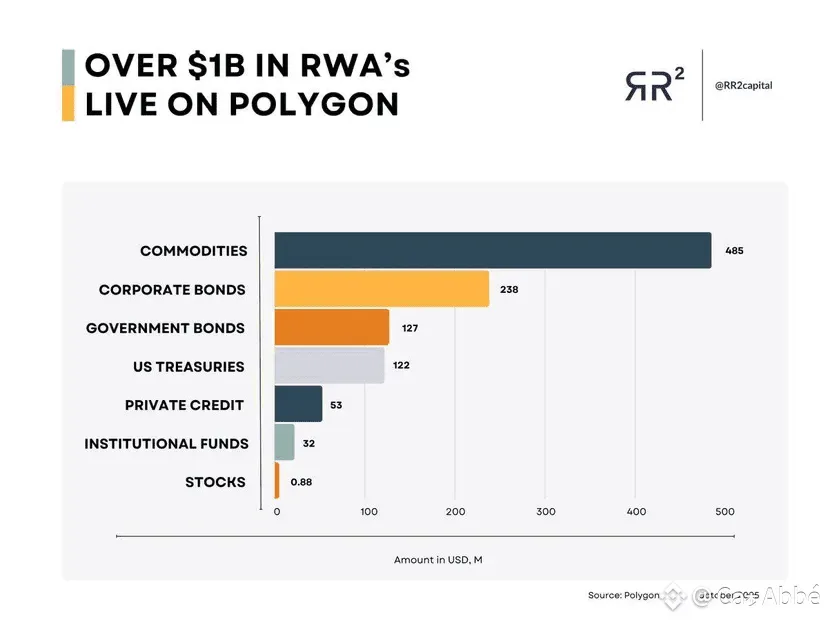

Concurrently, Polygon’s tokenized real-world assets (RWAs) surpassed $1.1 billion, marking the best quarter for Polygon to date. All of these changes unmistakably demonstrate the shift that has occurred from scalability to actual fintech utility through global financial networks.

Payments Growth Reinforces Network Strength

The payments ecosystem within Polygon’s PoS network achieved notable momentum in Q3 2025. Paxos led the growth with $319.4 million, a massive 443.2% QoQ rise. Avenia followed closely with $285.5 million, representing a 20.6% increase, while Revolut contributed $243.4 million, marking an 8.8% growth.

BlindPay nearly doubled its total to $198.7 million, representing a 91.7% increase, and Cobo recorded $117.8 million, a 76.1% increase. Collectively, other payment applications added $659.4 million, representing a 23.7% increase from Q2.

Monthly data captured this expansion clearly. Transfer volumes averaged $300 million in January and February, then rose sharply to $700 million by September. This ongoing expansion is indicative of a user base that is constantly growing, as well as the fintech partners being consistently integrated into Polygon’s scalable infrastructure. Such movements are a sign of a robust payment system that can handle both institutional and retail transactions with high efficiency.

Tokenized Assets Lead the RWA Frontier

However, the payment area was the only aspect where Polygon was used. It remained the primary platform for tokenizing real-world assets. According to RR² Research, the total value of on-chain RWAs has surpassed the $1 billion threshold, as stated in the news release on Binance. Commodities dominate this market segment at $485 million, while corporate bonds hold $238 million. Government bonds and U.S. Treasuries account for $127 million and $122 million, respectively.

Private credit is contributing $53 million, plus $32 million from institutional funds, indicating a significant commitment from large financial players. The stocks, although quite small at only $0.88m, are an indication of early adoption of equity tokenization. The sum of these numbers is an expression of growing trust in the asset-backed ecosystem of Polygon. The rich variety of assets points out the transition of the crypto world from DeFi to real-world finance.

Related: Vitalik Buterin Praises Polygon’s ZK Rollups and Scalability

Polymarket Expansion Adds to Ecosystem Growth

At the same time, DeFiLlama data indicate that Polymarket, the premier betting platform on Polygon, has a total value locked (TVL) of $234.7 million. Alongside this, the platform has also been credited with $3.16 billion in DEX volume over the past month, which is a significant indicator of the trading activity occurring on the platform.

Following the U.S. election market settlement, Polymarket saw its activity surge to $600 million, thereby confirming its leadership in the field of forecasting markets based on blockchain technology.

Despite Polymarket’s reported zero annualized fees and revenue, its statistics indicate that the user base will continue to grow steadily from 2024 to 2025. The increase in users coincides with the general rise in market activity, implying a connection between on-chain financial actions and real-world event speculation.

All in all, with these gigantic developments, Polygon holds the lion’s share of total value locked in prediction markets, which is 88%; thus, its position as a leader among Ethereum layer-2 ecosystems is further strengthened.

With the same technology, Polygon is merging real-world assets and digital payments under one scalable layer, and one challenging question comes up: Will the cooperation between RWAs and payment networks be able to create a self-reinforcing cycle of long-term utility that goes beyond market speculation?