Silver Overtakes Nvidia to Become Global Second Large Asset

- Silver overtakes Nvidia as the world’s second-largest asset amid tight supply levels.

- Physical silver shortages drive retail limits, mint delays, and widening premiums across markets.

- Industrial demand from energy, AI, and networks reshapes silver’s role in the global economy.

Silver has overtaken Nvidia to become the world’s second-largest asset by market value, trailing only gold. The shift reflects surging prices, tight physical supply, and growing industrial demand that now places silver at the center of global markets.

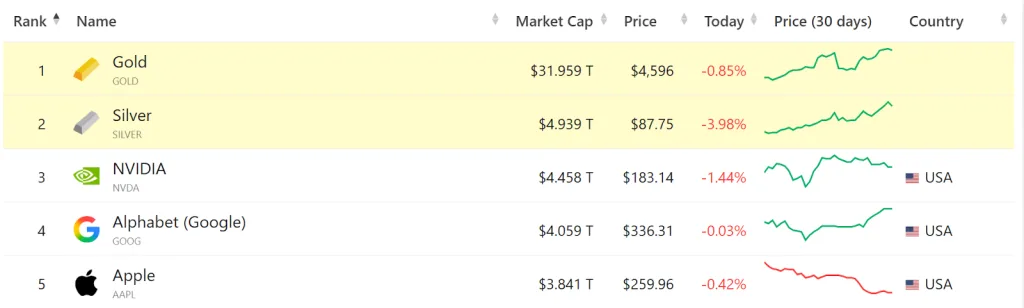

Data from companiesmarketcap.com shows silver with a market capitalization of about $4.9 trillion. With about $4.4 trillion, Nvidia is currently in second place. Gold remains far ahead, with a valuation above $31.9 trillion.

Source: companiesmarketcap

Silver prices have climbed sharply over recent weeks. On January 12, spot silver crossed $86 per ounce. Prices continued rising and reached new record highs soon after. Silver futures also surged. The rally confirmed earlier expectations that silver could surpass major equities.

As prices rose, signs of strain appeared in physical markets. U.S. retailers began limiting customer purchases. Costco capped buyers at ten units of 10-ounce silver bars per day. The retailer applied similar limits to 1-ounce bars. It also ended refund options for these products. Social media users reported even tighter limits in some locations.

Some stores reportedly allowed only one bar per customer. These restrictions signaled unusually strong demand for physical silver across retail channels.

Shortages also affected official mints. The U.S. Mint delayed the release of its 2026 American Silver Eagle coin. Officials moved the launch from January to February 26. The Mint confirmed limited quantities for the 1-ounce proof coin. Subscriptions for the release sold out ahead of time. The delay added to concerns about supply tightness.

Meanwhile, traders reported elevated premiums in physical markets. Some cited premiums near $82 per ounce. These levels far exceeded lower exchange spot prices. Such gaps pointed to stress in the physical supply chain. Producers and regulators, however, have not issued formal warnings.

Shortages Drive New Market Dynamics

Silver’s rise reflects more than investor demand. The metal plays a growing role in modern industry. Its unique conductive properties make it essential across several sectors. Green energy remains a major driver. Solar panels rely heavily on silver components. Electric vehicles also use large amounts of the metal.

Telecommunications add further pressure. Fifth-generation networks require silver for reliable signal transmission. Annual industrial use now exceeds global jewelry demand. Technology trends also support higher consumption. Artificial intelligence systems depend on high-precision electrical components. Robotics uses similar materials for sensors and circuits.

Silver rallies have historically coincided with advancements in technology. In the 1970s, electronics fueled demand. In the 2000s, digital devices expanded usage. Analysts see similarities to past cycles today. AI, automation and energy transitions create sustained industrial needs. These forces reshape silver’s position in global markets.

Related: As Gold and Silver Signal Fear, Crypto Rises in Financial War

At the same time, financial markets adjust to silver’s new ranking. The metal now sits behind gold as the most valuable asset globally. It also outranks major technology companies. Moneycontrol earlier reported silver’s climb toward second place. The recent data confirmed that projection. Market capitalization figures now reflect the shift.

Silver currently trades near $89.2 per ounce. Its market value stands close to $4.98 trillion. Industrial demand and supply limitations continue to have an impact on prices. Traders continue tracking retail limits, mint schedules and premium spreads. These indicators offer insight into physical availability. They also influence short-term price movements.