Dark Web Incognito Market Operator Sentenced to 30 Years

- Incognito Market enabled more than 640000 drug trades across a vast dark web network.

- Prosecutors linked fentanyl laced pills sold online to a fatal overdose in Arkansas.

- Investigators traced Incognito Market domains to Lin using real-world identity data.

Federal prosecutors in New York secured a 30-year prison sentence against Rui-Siang Lin for running Incognito Market, a dark web narcotics marketplace that sold over $105 million in illegal drugs worldwide. Jay Clayton announced the sentence after Lin pleaded guilty in December 2024 before U.S. District Judge Colleen McMahon.

Prosecutors said Lin owned and operated Incognito Market from October 2020 until its shutdown in March 2024, enabling hundreds of thousands of drug transactions across global networks. At sentencing, Clayton said Lin used the internet to distribute more than one ton of narcotics while earning millions and contributing to widespread harm, including at least one confirmed overdose death.

Can advanced technology ever shield large-scale criminal networks from accountability in the digital age?

A Dark Web Marketplace With Global Reach

According to a recent DOJ press release, Incognito Market operated on the dark web and allowed access through the Tor browser to users across the world with internet connectivity. Lin ran the platform under the alias “Pharaoh” and controlled all decisions involving vendors, buyers, site policies, and technical operations.

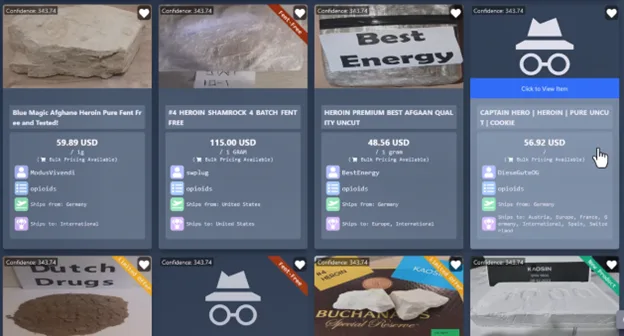

Under his leadership, the marketplace grew to more than 400,000 buyer accounts and supported over 1,800 vendors, many of whom operated as established drug traffickers. Investigators said the platform facilitated more than 640,000 individual drug transactions during its four-year operation.

Sales included over 1,000 kilograms of cocaine, more than 1,000 kilograms of methamphetamine, hundreds of kilograms of other drugs, and pills sold as prescription medication. In January 2022, Lin approved a policy that allowed vendors to sell opiates, expanding the site’s listings to include drugs marketed as authentic pharmaceuticals.

Fentanyl Sales and a Fatal Overdose

Law enforcement later confirmed that some pills advertised as oxycodone contained fentanyl instead of the listed medication. In November 2023, an undercover agent purchased tablets from Incognito Market that testing later identified as fentanyl rather than oxycodone.

Authorities linked similar pills to the death of a 27-year-old Arkansas resident in September 2022 after he consumed drugs purchased on the platform.

Prosecutors stated that Lin authorized opiate sales, which allowed vendors to sell dangerous counterfeit drugs throughout the marketplace. The Incognito Market platform functioned like a genuine e-commerce website because it provided branding solutions, customer service, and dispute-resolution systems.

The prosecutors described this design as a tool that enabled users to conduct extensive drug transactions while their illegal activities remained hidden through common internet designs.

Related: Hackers Sell Gemini and Binance User Data on Darkweb: Report

Investigation, Forfeitures, and Broader Enforcement

According to court filings, investigators traced Incognito Market’s domain registration to Lin after he used his real name, phone number, and address during setup. Taiwanese media reported that Lin studied at National Taiwan University and later completed alternative civilian service in St. Lucia, where he worked in technical assistance roles.

During that period, reports said Lin sometimes taught local police about cybercrime and cryptocurrency investigations. The sentencing followed recent Justice Department actions against other darknet operations, including the finalized forfeiture of more than $400 million tied to the Helix crypto mixer.

On the other hand, other prosecutions are like Helix operator Larry Dean Harmon, who pleaded guilty in 2021 and received a three-year prison sentence in November 2024. Earlier cases included a June 2025 seizure of 145 domains and cryptocurrency linked to BidenCash, plus a 2023 recovery action targeting assets tied to New Jersey trafficker Christopher Castelluzzo.