US-Iran Tensions Shake Bitcoin Prices Ahead of Nuclear Talks

- BTC slid toward $60K as U.S.–Iran nuclear talks revived geopolitical risk across crypto markets

- Over $260B exited crypto in a day as liquidations surged and sentiment dropped to extreme fear

- ETH, SOL, and DOGE broke key levels as leverage unwound during global risk-off trading

Renewed diplomatic strain between the United States and Iran is colliding with a fragile crypto market, sending Bitcoin and major tokens into a fast, liquidation-driven slide just as nuclear talks begin in Muscat, Oman.

Just recently online, a U.S. travel advisory urging Americans to “leave Iran now” resurfaced on X and added fresh headline risk. The guidance dates back to mid-January, but it reappeared as markets positioned for Friday’s negotiations and weighed renewed warnings from President Donald Trump alongside retaliation threats from Tehran.

Talks In Oman Open With High Stakes

According to reports, Iran and the United States opened high-stakes talks in Oman on Friday, with Iran’s Foreign Minister Abbas Araghchi leading Tehran’s delegation and U.S. Middle East envoy Steve Witkoff heading the U.S. side.

Jared Kushner, U.S. President Donald Trump’s son-in-law, was also expected to take part in the meeting, according to officials familiar with the matter. The agenda itself is a flashpoint. Per reports, Washington wants discussions to expand beyond the nuclear file to also cover Iran’s ballistic missiles, regional armed groups, and internal human rights issues.

Tehran, on the other hand, acknowledged that it wants the meeting to focus only on the nuclear issue. The talks come after last year’s sharp escalation in June, when the U.S. struck Iranian nuclear targets during the final stages of a 12-day Israeli bombing campaign.

Iran later said its uranium enrichment activities had stopped. As a result, Tehran has since warned it would respond forcefully to any military action and has made clear it will not negotiate over its missile program.

Old Travel Warning Returns And Reprices Risk

The resurfaced travel warning amplified market sensitivity to U.S.–Iran developments as it advised U.S. citizens to plan departure without relying on government evacuation support. The alert also referenced disruption risks such as flight cancellations and internet outages, language that traders often treat as a stress signal when it goes viral again.

Even though the advisory was not newly issued, its circulation landed at a moment when investors were already reducing exposure to risk assets. That timing helped keep U.S.–Iran headlines in the foreground as the Oman talks began.

Forced Position Closures Amplify Losses

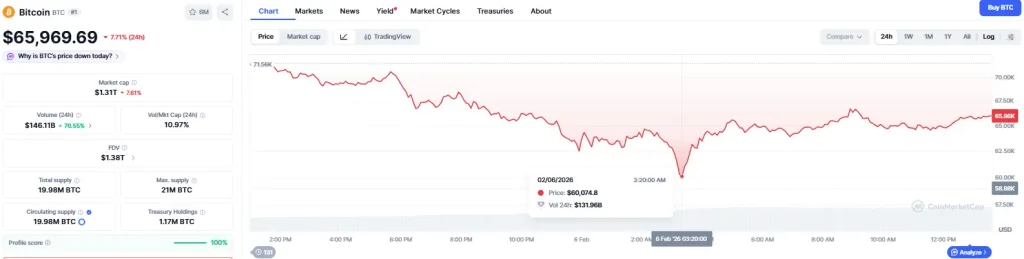

In the aftermath, the crypto sell-off took on a different character. What began as a steady decline hardened into a liquidation-driven slide as key technical levels failed. Bitcoin briefly probed the $60K mark, falling to an intraday low of $60,074 before recovering to roughly $65,969.

Source: CoinMarketCap

Even with the bounce, the damage was clear. Bitcoin remained down about 20% over the past week and 33% year to date, while Ether was still off roughly 32% in 2026 despite stabilizing attempts. The scale of forced positioning mattered as much as the news flow.

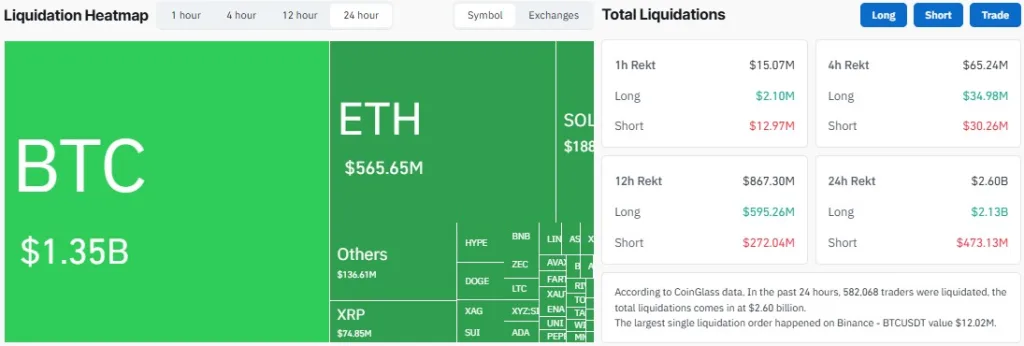

Source: CoinGlass

More than $2.6 billion in leveraged positions were cleared out over the past 24 hours, with close to 89% tied to long exposure. Bitcoin accounted for the largest share of those liquidations, followed by Ethereum. The pattern was familiar. Once downside momentum built, leveraged bullish bets were the first to unwind.

Liquidations And Fear Indicators Deepen Market Stress

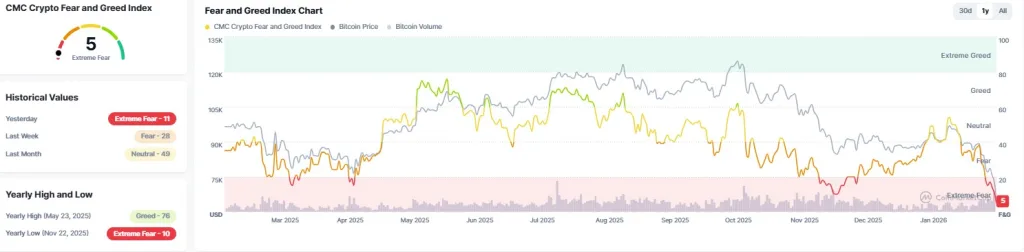

Signs of strain were also evident in sentiment gauges. The Fear and Greed Index slid to 5, a level categorized as “Extreme Fear,” down from 11 the previous day. Moves of that magnitude typically coincide with periods when traders are reacting to margin pressure rather than reassessing fundamentals.

Source: CoinMarketCap

Consequently, selling becomes mechanical, and decisions are made quickly and often reluctantly. However, losses were not contained to Bitcoin. Ether slipped below $1,800 during the downturn, while Solana fell under $70 for the first time since December 2023. Dogecoin also traded below $0.10.

Each break added to the risk-off tone, particularly in retail-driven assets where round numbers and prior support zones tend to concentrate stop orders and liquidation triggers. Broader market forces further added weight. The crypto drawdown unfolded alongside a sharp pullback in global technology stocks and a wider retreat from risk assets.

Source: SoSoValue

At the same time, sustained outflows from U.S. spot bitcoin exchange-traded funds, more than $1.61 billion withdrawn in January, reduced marginal demand just as liquidation-driven supply surged, leaving prices exposed during the selloff.

Related: Tether Buys 12% Stake in Gold.com With $150M Tokenized Gold Push

Why U.S.–Iran Risk Feels Bigger When Leverage Is High

The U.S.–Iran story landed in a market that was already structurally vulnerable. When leverage builds, price declines do not need a large new catalyst to snowball. Thus, liquidations can turn a headline-driven dip into a cascade, as each forced close becomes the next wave of sell pressure.

This makes the U.S.–Iran developments crucial even as officials clarified the travel advisory was not new. Regardless, with talks underway in Oman and both sides holding firm public positions, traders responded by reducing risk quickly, and the market’s plumbing did the rest.