Wall Street Strategy Fuels Altcoin Rally, BTC Dominance Drops to 61%

- Public companies use treasury strategies to drive altcoin rallies and raise capital.

- Bitcoin dominance falls 5.8% in one week, reaching its lowest level since March.

- ETH/BTC rebounds from support, indicating growing momentum for altcoins ahead.

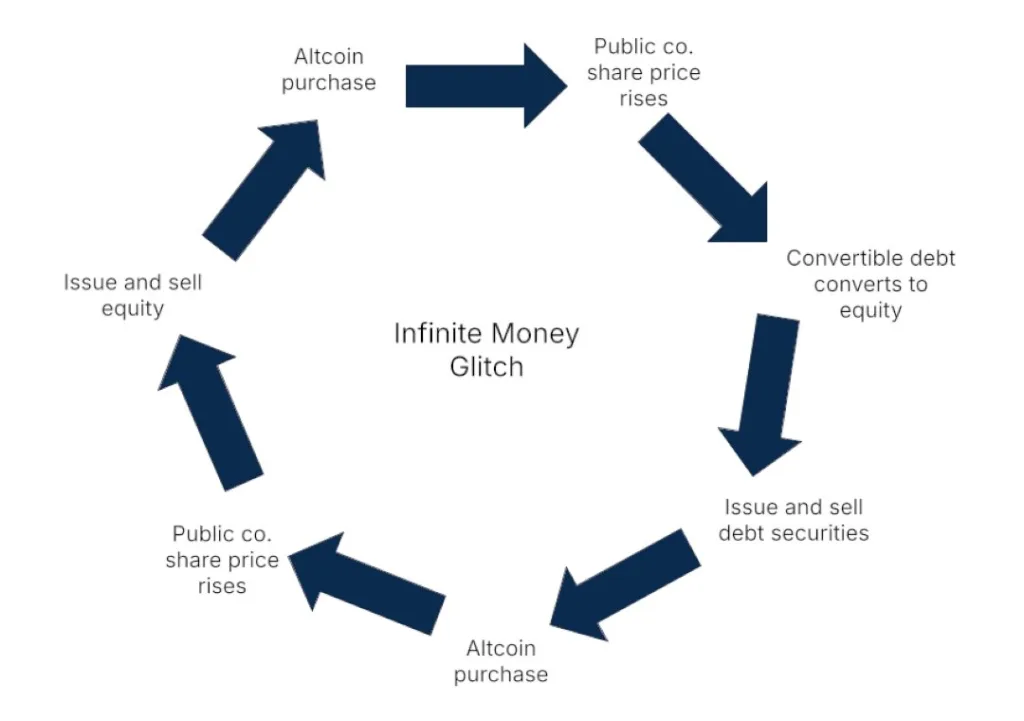

The growing crypto strategy of Wall Street, known as the “Infinite Money Glitch,” is transforming the flows of capital within the digital asset market. This framework focuses on the assessment of how public companies apply convertible debt and equity issuances that enable them to purchase crypto assets. Although initially used with Bitcoin, the companies are subsequently implementing this pattern with altcoins, like Ethereum, Solana, and XRP.

The cycle begins with an altcoin purchase, followed by a spike in the company’s share price. This enables bondholders to convert debt into equity at favorable terms, minimizing dilution. The company would then issue additional debt or equity at higher valuations and reinvest the money into future altcoin purchases. This cycle is repeated with continual increases in exposure to crypto, which contributes to investor interest and capital raises.

According to Animoca Brands Research, share prices rose by 226% less than 30 days after altcoin treasury announcements. Investors now view this equity-based exposure as a representation of altcoin investment, especially in light of the absence of U.S.-traded exchange-traded funds (ETFs) on non-Bitcoin assets. To gain altcoin exposure, investors are increasingly buying the stocks of public firms related to the tokens instead of directly purchasing them.

ETH/BTC Ratio Rebounds as BTC Dominance Falls Sharply

ETH/BTC has rebounded off a key support area of about 0.05 BTC, indicating that money is rotating out of Bitcoin. Previous altcoin rallies have started in this zone. As Ethereum rises, a decline in Bitcoin is likely to affect other altcoins as well, indicating renewed interest in the broader cryptocurrency market.

To further support this trend, according to TradingView statistics, Bitcoin’s market dominance has decreased by 5.8% within a week. It is currently at 60.8%, the lowest since March and its sharpest weekly dip since June 2022. This indicator measures BTC’s share of the total cryptocurrency market capitalization and is an indicator of changing investor attention.

Meanwhile, the overall cryptocurrency market cap reached the mark of around $3.8 trillion in three weeks from the $3 trillion mark. Altcoins, led by Ethereum, mainly contributed to this rise. The move is consistent with an increasing Altcoin Season Index (ASI), which is at 53 at the time of writing. Although the current level does not yet indicate a full altseason, this level suggests that altcoins are starting to gain strength over Bitcoin, which is a key condition in further rotation of capital.

Weakening Correlation and Liquidity Risk for Leveraged Positions

Market research from Alphractal highlights a weakening correlation between Bitcoin and altcoins. Their correlation heatmap shows average correlations dropping quickly, even turning negative. In previous cycles, such decoupling has preceded higher volatility and forced liquidations particularly for leveraged trades that expect synchronized price movements.

This change shows that altcoins are no longer following Bitcoin’s trend. This disruption in the correlation may provide unpredictable price action, with traders moving their portfolios out of BTC’s dominance.

Related: Bitcoin Surges to New ATH as Rising BTC Dominance Drains Altcoins

In addition, investor psychology is driving the shift towards altcoins. The preference to own whole units of cheaper tokens drives retail investors to purchase coins such as DOGE and XRP rather than fractional BTC. As Bitcoin trades below $120,000, newcomers perceive lower-priced tokens as more accessible or more likely to deliver higher returns, regardless of market cap or fundamentals.

Consequently, capital is still flowing out of Bitcoin and into altcoins, especially those with well-established narratives or low unit prices. This tendency in behavior further increases the decline in dominance levels of Bitcoin and supports the existing pattern of altcoin superiority.