XRP Price Sheds 4% as Analysts Signal a Possible Rebound Ahead

- XRP slips 4% from $2.98 but holds steady above strong support near the $2.80 mark.

- Trading volume rises as market activity stays strong despite XRP’s latest 4% pullback.

- Analysts highlight the $2.60–$2.90 range as the key zone for XRP’s possible rebound.

XRP slipped about 4% over the last 24 hours, sliding from $2.98 after hitting a firm resistance line. The token’s move followed weeks of trading inside a falling wedge, a setup that has shaped its path since July’s peak near $3.66.

That same pattern, however, often points to a market preparing for a rebound once sellers lose steam. The token now hovers just below the 23.60% Fibonacci level at $2.91, suggesting that traders may still test lower ground before finding balance.

Analysts watching the structure expect more short-term pressure but note that XRP could soon see a recovery if it holds its footing between $2.60 and $2.90. Many view that zone as a key springboard for renewed buying momentum.

At press time, XRP’s market capitalization has eased to $172 billion, a 3% dip that pushed BNB ahead as the world’s third-largest crypto asset. Even so, trading activity remains lively, with the daily trading volume ascending by 10% to $7.15 billion, showing that market interest has not faded despite the recent slide.

Analysts Predict a Possible Rebound

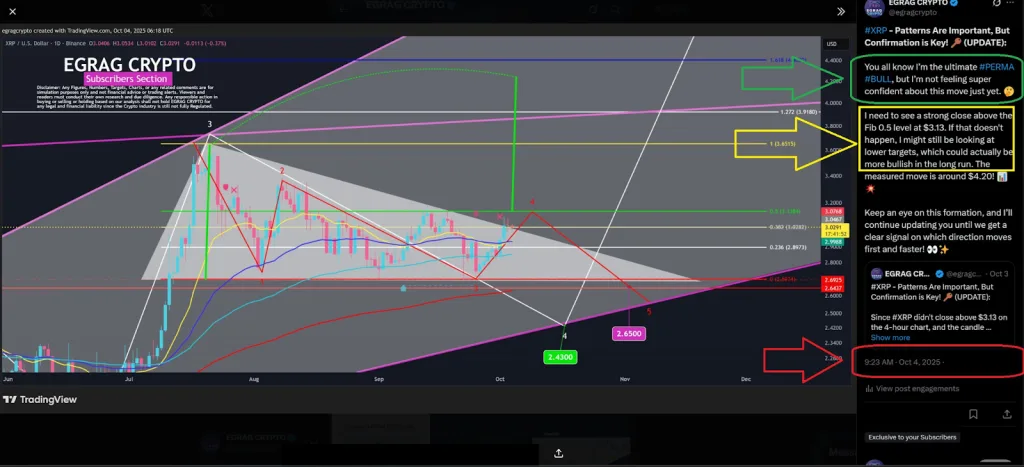

One of the leading voices in XRP’s movements, Egrag Crypto, has kept a constructive long-term view while urging patience in the short run. In his market post, he explained that XRP’s current structure fits within a descending triangle, a formation that still needs a clear breakout to confirm its next trend.

Egrag told followers that a daily close above $3.13, the Fib 0.5 level, would mark the first real sign of strength. Failing that, he expects the market to test lower zones. “If that doesn’t happen,” he wrote, “I might still be looking at lower targets, which could actually be more bullish in the long run.”

His analysis projects a potential climb toward $4.20 if XRP breaks above resistance, but he warned that the token could revisit $2.65 or even $2.43 first. Those levels, he said, line up with historical support and the triangle’s base.

Though his outlook carries a cautious tone, Egrag insists that any pullback could lay the groundwork for a stronger recovery later in the quarter. Another market observer, Ali_charts, shared a similar take but focused on a more precise descending triangle setup.

His chart shows XRP pressing through a series of lower highs while holding a steady support base around $2.72. Dotted projections on his chart show repeated rebounds between these boundaries before a breakout becomes likely.

Ali believes the token’s next step will likely involve a retest of the $2.72 support zone, which has served as a reliable floor since early September. If buyers step in again, the level could spark a turnaround. But if it fails, he warns of a deeper dip toward $2.60, matching concerns voiced by several other analysts watching the same structure.

Related: XRP Eyes $3.15 as Whale Activity Grows and Traders Watch ETF Moves

Trader Peter Brandt, known for his decades-long experience in classical chart analysis, compared XRP’s formation to a textbook descending triangle pattern first detailed by Edwards and Magee in the mid-20th century. Brandt shared a side-by-side image of the original example and XRP’s current chart, noting their similarity.

“ONLY IF it closes below $2.68743 (then I’ll be a hater), it should drop to $2.22163,” Brandt wrote. His projection follows the traditional measured-move formula, subtracting the triangle’s height from the breakdown point to estimate a downside target. He clarified that this view only applies if XRP closes below $2.687; otherwise, the market remains in a sideways consolidation.

In summary, XRP’s slide may be short-lived. Several market watchers believe the recent pause is part of a normal reset before momentum returns. If buyers protect the current support and strength builds near resistance, the setup could shift quickly, opening the door for a fresh rebound and renewed investor confidence.