XRP Price Steadies Above Key Support: Is a Rebound Past $2 Possible?

- The XRP price holds above the $1.84–$1.72 support after a 23 percent decline earlier.

- New ETF filings add institutional weight and bolster XRP’s long-term relevance.

- Technical pressure remains as XRP trades below key mid- and long-term moving averages.

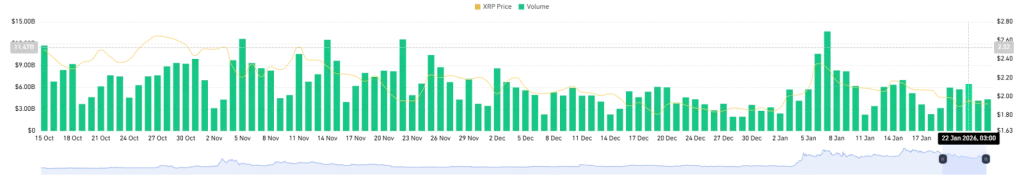

XRP has found its footing again after a volatile start to the year, settling near a familiar support pocket that traders have leaned on before. The token is hovering close to $1.91, not far above the wide $1.84–$1.72 band that has repeatedly slowed selling over the past several months. It’s not a dramatic recovery, but it has stopped the bleeding for now.

The slide that brought XRP back to this area unfolded quickly. Earlier in January, the price touched a descending trendline that has capped every meaningful advance since mid-2025. The rejection was sharp and immediate, roughly a 23% decline that erased the first week’s gains and forced a return to the same support zone that held during earlier pullbacks.

Support Zone Shows Its Weight Again

Notably, the market’s response at this level has been steady rather than spectacular. Sellers pushed hard into the range, yet the floor held, at least for now.

Its resilience this week has slowed momentum and kept price action compressed into a narrow band, reducing the pace of further declines. There is no strong rebound yet, but the absence of a breakdown has reset the tempo of trading. Activity has quieted, and the XRP price has slipped into a more patient rhythm as markets digest broader catalysts.

ETF Activity Adds a New Layer

Two regulatory filings this week helped shape the backdrop. Today, Cyber Hornet ETF LLC submitted paperwork to the SEC for a spot S&P Crypto 10 ETF, an index product that includes XRP with a 5% weighting. Based on reports, it’s the first U.S. spot ETF proposal tied to a broad crypto basket that features the token.

Even though its approval could take time, the inclusion alone reinforces XRP’s position in institutional portfolios. Besides, a day earlier, Ark Invest lodged its own application for the ARK CoinDesk 20 Crypto ETF.

Its benchmark, the CoinDesk 20 Index, assigns XRP a 19.88% weighting, placing it just behind Ethereum and Bitcoin in terms of index impact. Both filings underscore a quiet but steady rise in institutional interest that extends beyond single-asset products.

Technical Picture Still Tilts Cautious

Even with support holding, the chart structure leaves several hurdles in place. XRP continues to trade beneath the 50-day moving average near $1.99 and the 200-day at roughly $2.55. These levels now act as layered resistance, limiting the odds of a clean move back toward $2 without a decisive shift in momentum.

The long-running descending triangle remains intact as well. While not a verdict on direction, patterns like this often lean bearish if support eventually gives way. Moreover, momentum has yet to flip: the relative strength index sits near 41 and drifts lower, hinting that sellers still have room before pressure eases. If the floor breaks, the next notable level sits closer to $1.61, last year’s low.

Related: PI Holds Near $0.18 as Bearish Pressure Meets Oversold Signs

On-Chain Signals Point Toward a Pause

Futures metrics reflect the same cooling effect now seen on the chart. Open interest has dipped to around $3.34 billion after months of sideways movement, suggesting that few traders are willing to add exposure at current levels.

Futures volume, now about $4.35 billion, also shows participants largely holding positions rather than reshaping them. Together, these signals point toward a market waiting for clearer cues, technical, regulatory, or both, before committing to a direction.

For now, the XRP price sits between a durable support floor and a set of heavy resistance levels, with stability taking precedence over momentum.