ZKsync Price Jumps 150% in November as Token Gains Real-World Utility

- ZKsync surges 150% as trading volume and market value climb beyond $600 million.

- Network fees jumped 694%, putting ZKsync ahead of Arbitrum in Layer-2 growth momentum.

- The new ZKnomics model ties ZK token’s market strength directly to on-chain ecosystem use.

While most cryptocurrencies struggled through another volatile month, ZKsync quietly staged one of the most impressive rallies of the year. The network’s native token, ZK, soared over 150% in November, leaping from its recent low near $0.029 to a new peak of $0.075, its highest since May 15.

At press time, ZK traded close to $0.072, maintaining a 34% gain in 24 hours. Its trading volume also gained 42%, lifting its market capitalization past $600 million and securing a place among the top 100 digital assets.

However, what stands out is that this performance arrived during a market downturn that erased billions from other major coins. In a clear sign of demand, data from Nansen revealed a 694% increase in ZKsync transaction fees in a single week.

Source: X

That’s the steepest rise among all Layer-2 projects. The closest competitor, Arbitrum, recorded a 194% increase, less than one-third of ZKsync’s pace.

ZK Price Action—Market Structure Points Toward Stability

Technically, ZK’s rise has created a new support base. The $0.045 level, once a barrier, is now acting as a foundation for the next move. As of this publication, the token is trading above $0.062-$0.059, a local resistance turned to support.

Traders note that the token’s higher-high and higher-low pattern remains intact, a sign that the uptrend is still healthy. Besides, the 20-period Simple Moving Average sits below the current price, showing that buyers still have control.

Source: TradingView

On the other hand, volatility readings have started to cool, with the BBWP indicator narrowing after a sharp spike. This kind of pause often comes before a renewed price expansion. If ZK holds above the $0.062-$0.059 support range, another attempt past $0.079 looks likely.

However, if that support gives way, the next cushion may appear near $0.051. The Relative Strength Index (RSI) near 71 hints that short-term momentum is stretched, though the overall tone remains positive.

How New Tokenomics Are Fueling ZKsync’s Rise

The latest surge has as much to do with policy change as with speculation. Earlier this month, Alex Gluchowski, the founder of Matter Labs, introduced a detailed proposal titled “From Governance to Utility: ZK Token Proposal, Part I.”

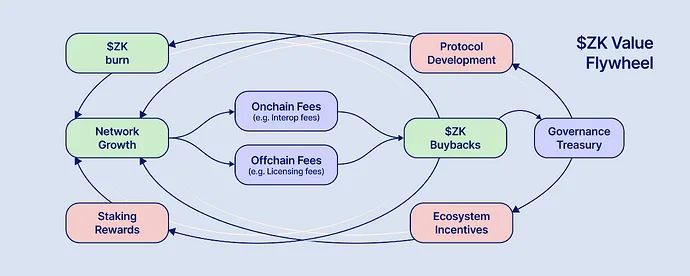

The plan marks a shift in how ZKsync’s ecosystem functions. Instead of serving mainly as a governance token, ZK will gain practical economic roles tied to network performance. The model introduces two main income streams: fees from its Layer-2 rollups and licensing revenue from off-chain enterprise tools.

Source: ZK Nation

Revenue collected from these sources will fund token buybacks, after which the purchased ZK will be distributed for burns, staking rewards, and grants to developers. In short, token value will depend on network use, not speculation.

The proposal followed the community’s approval of TPP-12, which opened the door for a staking pilot program. Holders can now lock their tokens and receive rewards while helping secure the protocol, a key piece of what the team calls ZKnomics, their long-term sustainability framework.

Related: Ethereum Price Falls 11% as $265M in ETH Exits Exchanges

Growing Interest in Zero-Knowledge Technology

ZKsync’s momentum also mirrors a growing belief in zero-knowledge proof (ZK) systems across the tech world. A recent a16z research report described ZK technology as “indispensable” for both privacy and scalability in next-generation blockchain systems.

The report noted that succinct proofs are being adopted in compliance platforms and even by major technology companies. Google, for instance, is experimenting with ZK-based identity verification tools. Such real-world integrations have strengthened investor confidence in ZK-focused projects, lifting sentiment around ZKsync in particular.