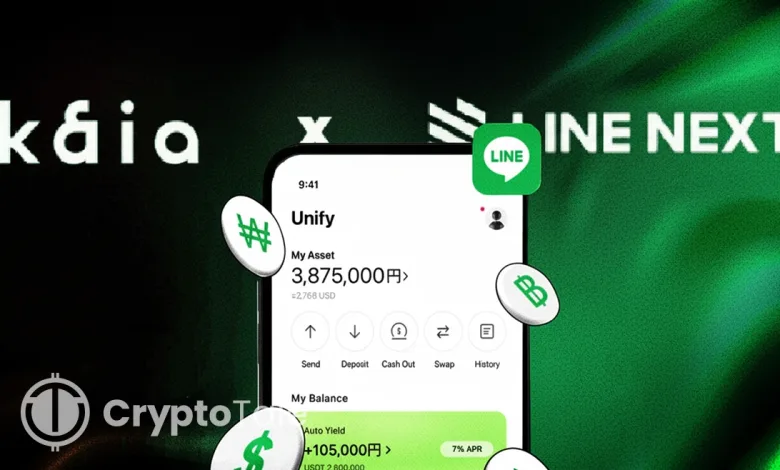

Kaia, LINE NEXT Unveil Stablecoin Web3 Super App in Asia

- Unify will bring stablecoin payments, remittances, and Web3 services into LINE Messenger.

- Super app will assist Asian currencies with tools for stablecoin issuers and developers.

- Regulatory frameworks in Asia will shape the expansion of Project Unify across markets.

Kaia DLT Foundation and LINE NEXT introduced Project Unify during Korea Blockchain Week in Seoul. The initiative will deliver a stablecoin-powered Web3 super app to millions of users across Asia. Integrated into the LINE Messenger with over 200 million monthly active users, it offers remittances, payments, and access to decentralized finance. The platform is described as “universally compliant,” integrating stablecoin payments, yields, on/off-ramps, and access to over 100 decentralized apps.

A New Platform for Stablecoins

Project Unify is built on Kaia, a unified blockchain created in 2024 through the merger of Kakao’s Klaytn and LINE’s Finschia. This combined network is managed by the Kaia DLT Foundation and designed for high throughput, low latency, and regulatory alignment. Kaia is also EVM-compatible and supports wallets, bridges, decentralized finance, games, non-fungible tokens, and over 400 existing projects.

The super app will be designed as a stand-alone product operated by Kaia or as a Mini DApp within the LINE Messenger. This structure utilizes the high user base of LINE in Japan, Taiwan, Thailand, and Indonesia, and Web3 features are more available. Offering services as an extension of an already existing messenger application makes the project accessible to regular people who do not necessarily understand blockchain tools.

Kaia describes itself as Asia’s “stablecoin orchestration layer.” At launch, Unify will support stablecoins pegged to major currencies, including the U.S. dollar, Japanese yen, Korean won, Thai baht, Indonesian rupiah, Philippine peso, Malaysian ringgit, and Singapore dollar.

Features and Services

The app’s services include direct peer-to-peer transfers of stablecoins. Users can also send tokens through LINE messaging or complete merchant payments both online and offline with instant settlement.

Fiat on- and off-ramps will connect local banking systems with stablecoin accounts. This conversion system aims to reduce friction for individuals moving funds between traditional finance and digital assets. Additionally, holding or depositing stablecoins inside the platform will generate real-time incentives such as interest and rewards.

Beyond payments and remittances, users will access more than 100 decentralized applications. These dApps cover areas including decentralized finance, gaming, and NFTs. To support broader participation, Unify provides developers and stablecoin issuers with a dedicated SDK. Through this toolkit, issuers can integrate their assets, and app creators can embed stablecoin payments and related services directly.

Related: Kaia Price Prediction 2025-35: Will It Hit $10 by 2035?

Regulation and Future Prospects

Regulation persists as a key issue for Project Unify. South Korean lawmakers are drafting a digital assets law that, among others, might govern stablecoin licensure, reserves, and generation of yield. Kaia itself has gone for the Filipino won stablecoin trademarks, thereby indicating readiness for the domestic regulated rollout.

Other Asian markets, such as Japan and Thailand, have adopted more advanced frameworks, allowing private stablecoins to operate under direct oversight. Unify has been described as a “universally compliant” initiative, which means it will adapt to each jurisdiction’s legal environment while scaling across Asia.

The project is also troubled with adoption issues. Many users do not yet know stablecoins, wallets, or blockchain applications. Merchant acceptance of stablecoin payments stands as a paramount technical requirement, and so is liquidity across multiple assets and security through a strong audit.

Unify is awaiting its Beta launch in late 2025 to integrate stablecoin markets across Asia into one big ecosystem. Moreover, with payments, remittances, and DeFi all tied to a single app, Project Unify could potentially bridge Web2 and Web3, thsu providing a new financial operating system for Asia.