SUI Holds Key Support at $2: What Comes Next, Surge or Dip?

- SUI trades at $2.00 after Mysticeti v2 upgrade boosts speed and network performance.

- RSI nears oversold while MACD stays bearish, showing weak momentum but easing pressure.

- Sui tops the sector with an average transaction size of $16,400, surpassing Tron and Base.

Sui Network has rolled out its Mysticeti v2 consensus engine, marking its most significant upgrade since July 2024. The new version streamlines how transactions are verified by checking them during the consensus process, reducing latency by almost 35%. This improvement aims to make Sui faster, more reliable, and better suited for developers building high-performance decentralized applications.

Analysts expect the effects of the upgrade to become visible in network activity over the coming weeks. While the immediate price impact has been modest, the enhancements could drive higher transaction volumes and attract new dApp launches as user metrics start reflecting the improvements.

At press time, SUI traded at $2.00, up 0.58% in 24 hours, with $1.03 billion in trading volume. The network’s market capitalization rose to $7.38 billion, signaling renewed investor confidence following the rollout.

Institutional Repositioning Near Support

Prices briefly slipped below $2.00, indicating possible institutional repositioning at key support levels. However, large sell orders were quickly absorbed, allowing SUI to rebound to $2.02 shortly after.

The reaction shows strategic accumulation near psychological support, supporting the $1.93–$1.96 range as a key short-term zone. Sustained trading above this level may attract sidelined capital, but a break below it could lead to automated sell orders.

The $2.00 region, therefore, is an important level for both traders and institutions. Overall market sentiment is still holding back gains, with the crypto Fear & Greed Index at 21, showing continued caution.

Related: Zcash Hits $588 as Whale Positions Surge and Hayes Eyes $1K

Technical Indicators Point to Weak Momentum

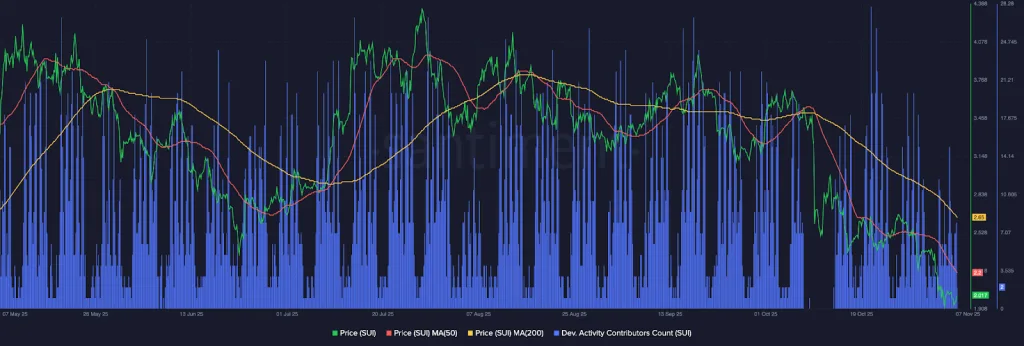

Sui’s price has dipped over 50% since early May, when it traded above $4.30. The moving averages confirm the sustained downtrend. The 50-day MA is near $2.20, while the 200-day MA is around $2.65, both trending downward. The MA50’s earlier cross below the MA200 in October has formed a death cross pattern that continues to cap short-term gains.

The RSI is at 32.77, nearing the oversold level. If the RSI moves back above 40, it could mean short-term buying strength is returning. Still, the MACD stays bearish, with the MACD line at –0.2372 sitting below the signal line at –0.2171. The narrowing bars show that selling pressure is easing, but there’s still no clear sign of a recovery.

Resistance lies between $2.10 and $2.20, with a stronger barrier near $2.50. Support levels sit around $1.90 and $1.70. Keeping the price above $2.00 is important to prevent more declines.

Liquidation data from Coinalyze shows total 24-hour liquidations at $1.6 million, with $1.3 million from long positions and $274,000 from shorts. Binance led with around $1 million in liquidations, followed by Bybit at slightly below $0.5 million.

Market analyst Eye Zen Hour noted that Sui leads the sector in average transaction size at $16,400, higher than Tron’s $10,500 and Base’s $9,100. This suggests bigger capital movements and growing institutional activity on Sui’s network.

Sui holding around $2.00 shows cautious optimism as traders watch post-upgrade performance and liquidity trends. Weak momentum, large-scale buying, and high-value transactions point to a consolidation phase in the coming weeks.