AAVE Drops 10% After Whale Dumps $38M in Tokens Fast

- AAVE slid about 10% after a whale sold 230,350 tokens worth roughly $38 million.

- On-chain data shows the whale swapped AAVE into stETH and wrapped Bitcoin during the sell-off.

- AAVE hovered near $160 as buyers stepped in amid heavy volume and short-term liquidity stress.

The AAVE market saw sudden turbulence as one large wallet left its position. It caused heavy selling, rising volatility, and fast liquidations across trading venues. Analysts tracked on-chain data, governance debates, and early buyer reactions. They assessed whether the drop signaled a short-term shock or weakness.

Whale Exit Triggers Sudden AAVE Price Drop

AAVE price fell almost 10% in hours following a huge wallet leaving positions. On-chain only indicated that the wallet had sold approximately 230,350 AAVE tokens at once. The complete sales price was nearly $38M.

The quick implementation led to lower liquidity and forced the prices towards the $158 range. As of writing, AAVE has a value of $160.88 with a 10.14% price reduction over the past 24 hours.

The movement was verified by blockchain trackers via publicly displayed records of transactions. The wallet transformed AAVE holdings into stETH and wrapped Bitcoin assets. The rotation was an indication of a shift to more deeply liquidated assets. The market was already concerned when the trade was closed at a realized loss.

On-Chain Data Confirms High-Volume Selling Activity

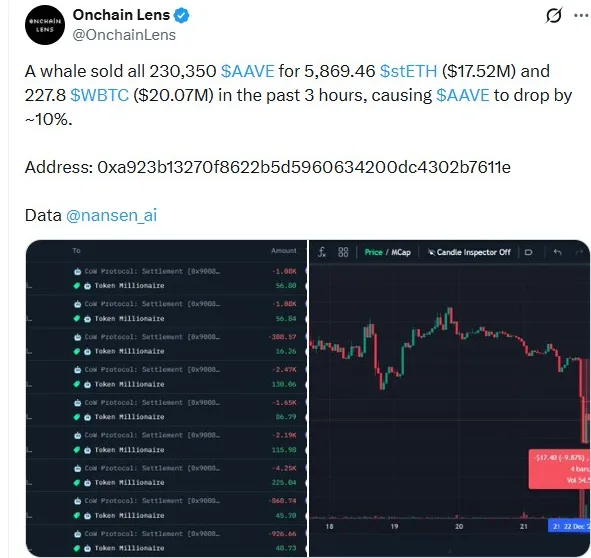

Lookonchain and OnchainLens reported the transactions soon after execution. The data showed multiple swaps completed within a short time window. This pattern pointed to intentional risk reduction rather than gradual portfolio adjustment. Traders reacted quickly as sell volume expanded across major exchanges.

Source: X

The volume data demonstrated the improvement over current daily averages. This growth favored the perspective of concentrated supply in the marketplace. This was followed by weak prices as stop orders were triggered close to intraday support levels. The downward trend of short-term momentum changed across decentralized finance tokens.

Governance Discussions Add Context to Market Reaction

Moreover, the sale occurred at a time when certain governance discussions were happening in the AAVE DAO. Interface fees and protocol control structures are the subject of debate amongst community members.

Other changes to be introduced include the review of tokenholder incentives. These deliberations can have an impact on confidence when the market is under stress.

Large holders often react faster to uncertainty around governance direction. Reduced clarity can encourage defensive positioning among institutional wallets. The whale exit occurred during heightened attention on these proposals. However, no official decision had been finalized at the time of selling.

Related: WLFI Extends Downtrend with 6% Drop, But Technicals Hint at a Potential Bottom

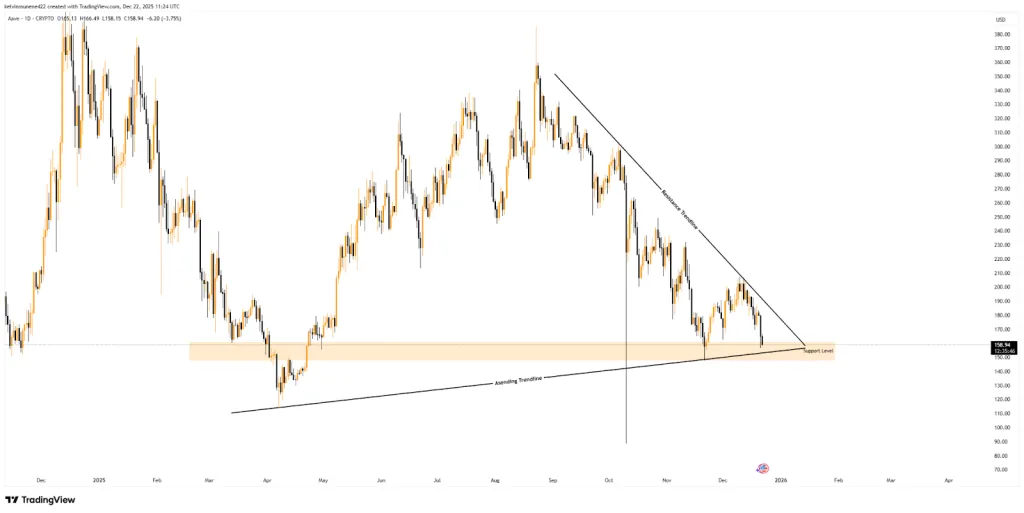

Buyers Reappear as AAVE Tests Key Support Levels

After the initial decline, buying activity appeared near the $160 zone. This area served as short-term support during previous trading sessions. Spot demand helped slow further downside movement after the sharp drop. Price action stabilized as volatility eased later in the session.

Source: TradingView

Technical charts show AAVE approaching a longer-term ascending trendline. This structure has been held several times since mid-2025. A sustained defense could allow price recovery toward prior trading ranges. Failure to hold may open room toward lower support near $140.

AAVE fundamentals remain unchanged despite the sudden market shock. The GHO stablecoin supply recently reached a new high of nearly 350 million. Development work on AAVE V4 continues ahead of planned releases. Short-term price moves remain sensitive to large wallet actions and liquidity conditions.