WLFI Records Strong Rally Fueled by BNB and Solana Expansion

- WLFI surges by 28% after StableStock’s USD1 integration on BNB and Solana networks.

- On-chain data shows easing sell pressure and rising accumulation since early November.

- Technicals confirm bullish momentum with RSI near 70 and MACD showing upward strength.

WLFI recorded one of its strongest daily moves on November 10. At press time, the token was up by 28.36% to trade at $0.1563 with trading volume up by 528%. The token’s market cap reached $3.84 billion, while 24-hour trading volume surged to $538 million. The rally followed an update linking WLFI to StableStock’s USD1 integration across the BNB and Solana networks.

StableStock Integration and Renewed Activity

WLFI’s partnership with StableStock has allowed users to deposit, trade, and settle directly in USD1 within the platform’s ecosystem. This move offers 24-hour access to nearly 200 tokenized U.S. stocks and ETFs.

Built on the BNB Chain, USD1 strengthens liquidity flow between tokenized equities and blockchain assets, connecting traditional finance to decentralized markets. The update aligns with WLFI’s plan to build stablecoin-backed financial infrastructure, improving transaction reliability and accessibility for StockFi participants.

In addition, WLFI announced ongoing efforts to promote USD1 adoption on Solana in collaboration with Bonk.fun and Raydium. The project confirmed acquiring USD1 for its strategic reserve, showing its goal of developing a Solana-native liquidity base.

This renewed focus on cross-chain functionality and stablecoin modes has coincided with a surge in trading activity, lifting WLFI’s price from recent lows near $0.12 to its current range above $0.15.

Signs of Accumulation

Data from late September through early November shows a changing liquidity outlook. Between late September and mid-October, outflows dominated the market, with deep red bars of –$3 million to –$12 million indicating heavy selling pressure. A steep –$15 million outflow on September 30 coincided with WLFI’s price dropping from $0.27 to $0.16.

Source: Coinglass

Although brief positive netflow spikes occurred on September 26, October 10, and October 24, each between $3 million and $6 million, they were insufficient to reverse the broader downtrend. By early November, WLFI hit a low near $0.12 before rebounding to $0.15 on November 9, even as another large –$12 million outflow appeared.

The rebound, backed by stronger trading activity, shows early signs that investors may be buying again as selling pressure slows down. Staying above $0.15 is important for WLFI to hold steady and possibly aim for the next resistance levels between $0.18 and $0.21. But if large sell-offs return, prices could fall back toward the $0.12 support zone.

Related: WLFI Expands USD1 on Solana Ecosystem with Bonk and Raydium Partnership

Technical Indicators Point to Short-Term Strength

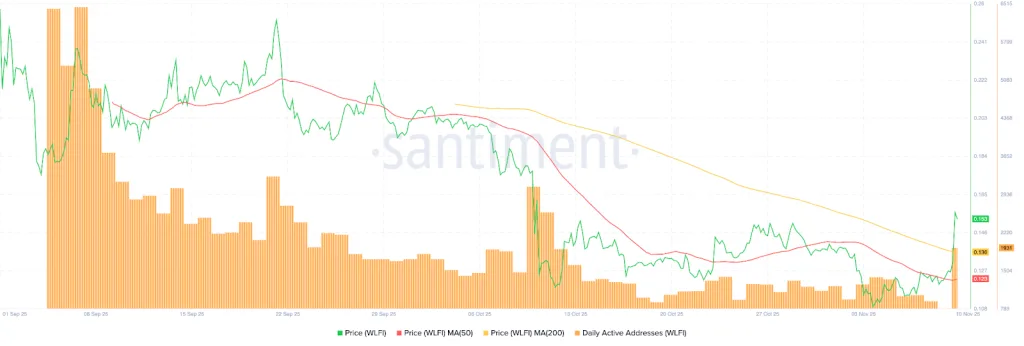

From September to November, WLFI’s technical indicators showed major transitions in trend direction. The token traded between $0.24 and $0.26 in early September, with over 6,000 active users each day. But by mid-September, activity dropped sharply to below 3,000, which also weakened price support.

Source: Santiment

In early October, the 50-day moving average slipped below the 200-day moving average, signaling a continued downward trend. WLFI then slid from $0.20 to $0.12 by late October, with daily active addresses dropping to roughly 1,000.

A reversal began on November 9–10, when WLFI climbed 24% to $0.153 alongside a recovery in active addresses to nearly 1,930. On the 4-hour timeframe, the RSI is at 69.78, just below the overbought mark of 70. This shows strong buying interest, though a brief pullback could occur if the RSI crosses higher.

Source: TradingView

The MACD line is above the signal line at 0.0021, with growing green histogram bars confirming upward momentum. WLFI’s breakout above its previous resistance at $0.135 established new support between $0.140 and $0.145, while immediate resistance is near $0.165–$0.170. A close above that level may lead toward $0.185–$0.190.

WLFI’s surge follows a combination of technical recovery and expanding stablecoin integration within its ecosystem. Sustaining price strength above $0.15 while holding key support zones would support short-term bullish momentum. However, any drop below $0.130 could push the token back into its prior consolidation range before inflow confirmation.