AVNT Retreats From ATH as Profit-Taking Tests Market Outlook

- AVNT hit $2.66 before dropping 20% as profit-taking cooled bullish momentum.

- Technical signals indicate resistance at $2.10 and fragile support near $1.90.

- Open interest decline and liquidation clusters shape the token’s next direction.

Avantis, a Base-powered decentralized perpetual exchange, saw its AVNT token climb to new highs. Earlier yesterday, the token surged to a record high of $2.66 before easing back toward $2.04 at press time.

The cryptocurrency has increased by more than 100% over the past week, while its market capitalization has nearly doubled to approximately $527 million. The explosive rally was fueled by heavyweight exchanges Binance and Coinbase, which confirmed AVNT listings earlier this month.

Binance added even more momentum by unveiling a 10 million-token airdrop for BNB holders, sparking a wave of new buyers. That momentum, however, has cooled. AVNT has since dropped more than 20% from its all-time peak. Besides, its daily trading volume has fallen sharply to $2.27 billion, a 69% slide.

The sharp reversal suggests many early investors may be taking profits, raising questions about whether Avantis can sustain its rapid growth. Will bullish sentiment return, or is the market bracing for a deeper correction?

AVNT Price Action: Technicals Show Balance of Risk and Reward

Since topping its all-time high, AVNT has been tracing a falling wedge formation, often seen as a signal for an upcoming bullish breakout. The token tested resistance near $2.10 after rebounding from a low of $1.74, marking a 21% climb. But failed to break through the resistance, leading to a decline in price.

This resistance zone aligns with the wedge’s upper boundary, the 38.2% Fibonacci retracement, and the 50-period moving average—making it a critical level to monitor. A decisive move above could reignite bullish momentum and open the door toward the 50% Fib level at $2.21, with further targets at $2.47 and a possible retest of its record high.

For now, AVNT holds above the 20-period MA around $1.97, serving as a short-term support base. A drop below could push the token back into the $1.82–$1.74 range, where buyers may step in for another rally. However, a sustained breakdown under this band would expose the 100-period MA and risk invalidating the bullish wedge outlook altogether.

Momentum signals suggest caution. The RSI sits near neutral territory at 48.84, pointing slightly downward, which indicates room for more downside before oversold levels are tested. This tilts sentiment toward short-term bearishness, hinting at a period of consolidation.

Related: Story (IP) Hits $14.92 Amid Rally, Overbought Signals Emerge

Leverage Unwinds, Pressure Mounts on Price Action

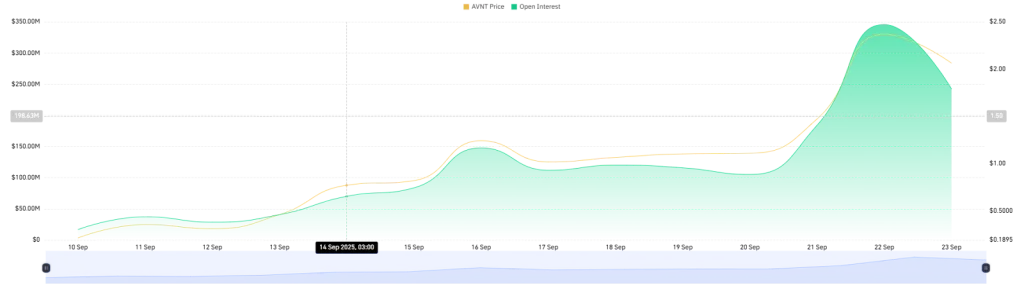

On-chain data reinforces this shift. Futures open interest has declined from $345.6 million to $242.4 million, showing that traders are locking in profits and scaling back exposure. This reduction in leverage could add pressure on prices in the near term, shaping AVNT’s next move.

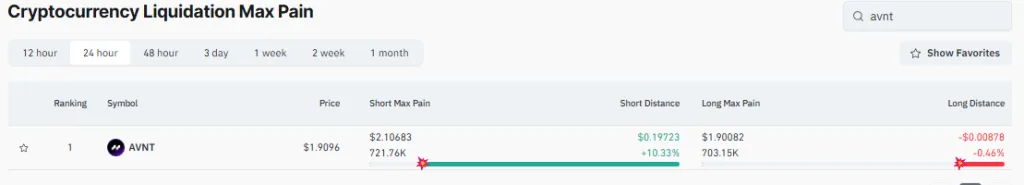

The latest liquidation data adds another layer to AVNT’s price action. On the upside, short liquidations are clustered around $2.10, a zone where nearly $721,760 could be wiped out if buyers manage to push higher.

This level also coincides with key technical resistance, making it a pivotal test for momentum. On the downside, long liquidations sit close to $1.90, with more than $703,150 at risk. The narrow distance to this level, less than half a percent, shows that bulls are defending a fragile floor, and any weakness could quickly flip sentiment bearish.

Conclusion

AVNT’s recent surge and sharp retracement highlight the delicate balance between bullish optimism and profit-taking pressure. With technical signals, leverage data, and liquidation levels shaping sentiment, the token sits at a decisive crossroads.

Whether buyers reclaim momentum or sellers force a deeper correction, upcoming moves will test market conviction. For now, traders remain watchful as AVNT navigates resistance above and fragile support below, keeping its short-term outlook finely balanced.