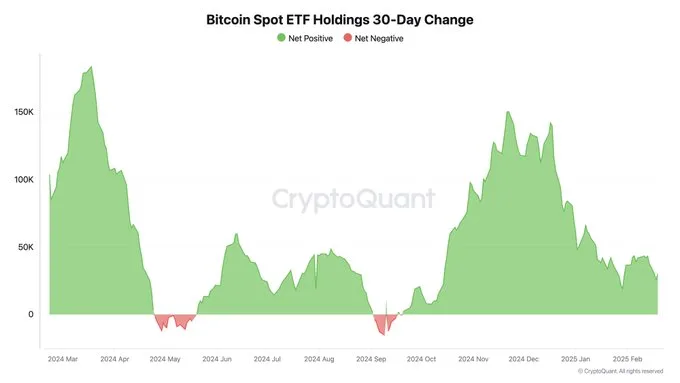

ETF Inflows Slump as Bitcoin ETF Demand Cools Dramatically

- BTC ETF inflows fell from 100,000 BTC in 2024 to 41,000 BTC in 2025, signaling waning demand.

- Inter-exchange flow to Coinbase dropped below its 90-day average, indicating reduced interest.

- On-chain activity dipped below its 365-day moving average, hinting at broader market hesitation.

Bitcoin ETF enthusiasm appears to be cooling as recent data reveals a notable slowdown in institutional demand. CryptoQuant founder Ki Young Ju highlights that while ETF demand remains net positive, its momentum has diminished compared to the late 2024 surge.

Source: X

The slowdown becomes more apparent when examining specific timeframes. Bitcoin demand has fallen from 279,000 in December 2024 to approximately 70,000 today. ETF activity paints a similar picture, with net inflows declining from their peak of 18,000 BTC to a current outflow of 1,000 BTC.

Ki Young Ju emphasizes that this bull cycle’s longevity depends primarily on ETF flows. He suggests that prolonged negative demand could signal the start of a bear cycle, simplifying market analysis to basic supply and demand principles. This perspective strips away market noise to focus on fundamental drivers of price action.

According to Julio Moreno, CryptoQuant’s head of research, current spot ETF demand has dropped to less than half of last year’s levels. Net inflows in 2025 reached 41,000 Bitcoins, a sharp decline from the 100,000 BTC recorded in 2024. This reduction in institutional appetite marks a clear departure from the previous year’s robust growth.

The decline in demand is not only the case in ETF markets, as the same has occurred for Bitcoin itself. CryptoQuant’s Inter-exchange Flow Pulse offers additional insight into this trend. The metric tracks Bitcoin movements from various exchanges to Coinbase often considered a proxy for U.S. institutional interest. Recent data shows this flow falling below its 90-day moving average, indicating waning buying interest across both institutional and retail sectors.

Network activity presents another perspective on market health. The Bitcoin Network Activity Index has dipped below its 365-day moving average for the first time since China’s mining ban in July 2021. This decline in on-chain activity suggests market hesitation beyond just institutional investors.

Related: El Salvador Buys 1.6 BTC Daily, Boosts Holdings to 6,081 BTC

The current market environment offers valuable lessons for investors. While institutional adoption through ETFs represents a major advancement for Bitcoin, the initial surge in demand appears to be normalizing. This pattern aligns with historical market behavior, where new investment vehicles often experience strong initial interest followed by more measured participation. Looking ahead, market participants should monitor ETF flows as a key indicator of institutional sentiment.